Contents:

This means that the firm is putting its resources to the best possible use at that particular time. Let us take the example of a cafe, Mugs & Sips, that reported total revenue of $200,000 and explicit costs of $50,000 during FY 2023. The explicit costs include every type of expense that a company is liable to pay. Some examples are wages, inventory costs, sales and production costs, taxes, etc. What is Joe’s economic profit if he brings in a total of $53,000?

Opportunity Cost Formula, Calculation, and What It Can Tell You – Investopedia

Opportunity Cost Formula, Calculation, and What It Can Tell You.

Posted: Wed, 19 Jul 2017 07:03:14 GMT [source]

OpenLearn works with other organisations by providing free courses and resources that support our mission of opening up educational opportunities to more people in more places. A company’s pursuit of profit is for the benefit of shareholders. As such, before issuing dividends, you’ll need to calculate profit per share. For this, you’ll need to calculate the net profit and divide it by the number of outstanding shares. As such, you’ll have full visibility of your company’s financial health. For you to identify the best investment options and capitalize on them, you need to be strategic.

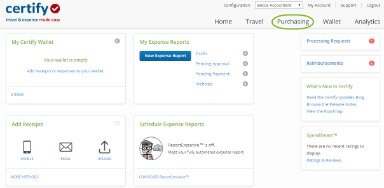

Freshbooks – Best Software for Accounting Profit

Generally, you may turn toward your accounting profit to see how your company is doing. You also need to consider other types of profit, such as economic profit. But, what’s the difference between accounting profit vs. economic profit?

- They are both important indicators of a company’s financial health but should be considered in conjunction with other financial ratios to get a complete picture.

- The three major types of accounting profit are Gross profit, Operating profit and Net profit.

- Opportunity cost is the potential forgone profit from a missed opportunity—the result of choosing one alternative and forgoing another.

- The tax law of the business’s jurisdiction will provide information regarding which expenses are deductible and which are not.

- There is another term that economics use, and it is normal profit.

- In fact, implicit costs come into the picture during the calculation of economic profit of a company.

This issue is only a problem if the accrual basis of accounting is used. After calculating the company’s gross revenue, all operating costs are subtracted to arrive at the company’s operating profit, or earnings before interest, taxes, depreciation, and amortization . If the company’s only overhead was a monthly employee expense of $5,000, its operating profit would be $3,000, or ($8,000 – $5,000). Accounting profit shows the amount of money left over after deducting the explicit costs of running the business. Accounting profit or financial profit is a company’s net income that they compute by subtracting explicit costs from the year’s revenue.

Types of Profit

As mentioned above, implicit expenses consist of the opportunity costs of a business. Businesses can calculate their opportunity cost by considering alternative uses for their resources. Explicit expenses are the opposite of implicit expenses, which consist of costs that are not a part of the accounting system of a business and mainly refer to opportunity costs. Gross Profit is the income a business has left after paying all their variable costs directly related to the manufacturing of their products and/or services .

- This is because the cash flow approach does not consider non-cash flow expenditures.

- Aaron has worked in the financial industry for 14 years and has Accounting & Economics degree and masters in Business Administration.

- After those non-operating costs have been subtracted from EBIT, we’re left with the company’s pre-tax income, or earnings before taxes , i.e. the taxable income of the company.

Once standardized into percentage form, Apple’s net profit margin can now be compared to its historical periods and to its comparable peers to better understand its profitability in 2021. As a measure of profitability, the net profit metric can misleadingly portray a company’s financial well-being from a liquidity and solvency standpoint. Once the company’s pre-tax income has been reduced by its tax expense, we’ve arrived at the company’s net income. The taxes owed to the government are based on the corporate tax rate and jurisdiction of the company among various other factors (e.g. net operating losses, or NOLs). Cost of Goods Sold → The direct costs related to the company’s core operations generating revenue.

Accounting Profit vs. Economic Profit Assets

The total revenue is all the money acquired from selling the firm’s products at a given price. Total cost, on the other hand, refers to all the costs incurred during production. For small business owners, going on gross profit margin may suffice. However, for a growing company you’ll need to go a level further and calculate the operating profit.

How to Create a Profit and Loss Statement: Step-By-Step – The Motley Fool

How to Create a Profit and Loss Statement: Step-By-Step.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

In most circumstances, accounting profit will exceed economic profit. This is because organizations frequently incur opportunity costs for operations eschewed in favor of other activities. Assume a corporation has $100,000 to invest, and suppose it foregoes one chance in favor of another. In that case, the potential money from the foregone opportunity is incorporated into economic profit but not accounting profit. On the other hand, an opportunity cost might be a cost avoidance assessment that results in a smaller accounting profit.

It consists of all the non-production costs, which some companies list as a separate line item. The net profit figure comprehensively displays the profitability of a business, and it is used in publicly traded companies to calculate their earnings per share . Implicit expenses are subjective because businesses make judgments to calculate them. Explicit expenses are those expenses that a business can identify and measure.

To arrive at accounting profit a unique formula generally accepted is needed. The basic type of profit formula is generally Explicit Costs subtracted from Total Revenue. On the other hand, detailed profit formula is Cost of Goods Sold subtracted from Total Revenue, which results to Gross Profit. Once Taxes are added to Operating expenses and subtracted from Gross Profit, the result is Accounting Profit. As a result, accounting profit formula to arrive at Accounting Profit in its totality is Total Revenue minus (-) (Cost of Goods Sold plus (+) Operating Expenses plus (+) Taxes). One example of accounting profit would be a company that has earned $100,000 in revenue throughout a given year but has incurred expenses totaling $90,000.

Calculating accounting vs. economic profit

To help you understand the distinction between the two, let’s look at implicit and explicit costs, which are the two types of costs. The economic profit of a company reflects economic principles more than accounting principles. The operating profit determine how profitable the company is after all the operating expenses has been deducted. Operating expenses are things like material cost, labour cost, production and overheads, transportation, sales and marketing cost etc. Operating is calculated by subtracting the operating expenses from the gross profit.

Accounting profit is a metric used by management to assess the current performance of the business, as well as compare its current financial position relative to competitors across the industry. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. By understanding the definition, formula, and factors affecting net profit, as well as how to calculate it, you can get a better sense of your business’s bottom line. Review your monthly expenses and examine where you can cut back, such as on office supplies, marketing costs, or travel expenses.

The three major types of accounting profit are Gross profit, Operating profit and Net profit. The net profit margin can be calculated by dividing the net profit by sales. The matching principle states that all the expenses that happened in the period to produce the income must be recognized.

This means that you’ll only identify the limiting factors at the end of the accounting period. However, if youcalculate profit marginmonthly, you’ll identify limiting factors much sooner. As such, you can address them much earlier and increase profitability for the year. In any given period, the reported profit figure may contain an unusual spike or decline in revenues or expenses, so that the outcome can be considered out of the ordinary.

In Section 2 we looked at the three elements of the accounting equation – assets, liabilities and capital – and how these three elements are presented in the balance sheet. However, a business’s trading activities, i.e. its income and expenses incurred in order to generate profit, are not shown in the balance sheet. These include the cost of labor, raw materials, debts, administrative costs, and nonoperational costs. However, you’ll ultimately need to know how much is left after accounting for all expenses and revenue streams. This is known as the net profit, which reflects your company’s ability to convert income into profit. However, there are some cost factors that operating profit does not account for.

Profit Margin: Definition, Types, Uses in Business and Investing – Investopedia

Profit Margin: Definition, Types, Uses in Business and Investing.

Posted: Sat, 25 Mar 2017 19:01:44 GMT [source]

And, it is specified by the generally accepted accounting principles . Accounting profit is the amount of money that a company earns through its operations, minus the costs of doing business. To calculate accounting profit, companies subtract all of their expenses from their total revenue for a given period. This number is then used to measure the company’s financial performance over that particular time frame. Accounting profit, also referred to as bookkeeping profit or financial profit, is net income earned after subtracting all dollar costs from total revenue.

The business incurred the costs of the labor it must however recognize the costs in the current period even though the checks will only clear in the next accounting period. Economic profit is the difference between the revenue received from the sale of an output and the costs of all inputs, including opportunity costs. Explicit costs include labor, inventory needed for production, and raw materials, together with transportation, production, and sales and marketing costs.

Nonetheless, you’ll need to include the depreciation of assets and amortization. FreshBooks is special accounting software that has been offering business diverse financial management tools and features for over a decade. Let’s say your business sells $20,000 worth of products, and it cost you $8000 to make them. With additional operating expenses of $3000 and taxes of $4000, the calculation would go like this.

Therefore, Foodland Stores Ltd. generated an accounting profit of $2.85 million during the year 2023. It has the advantage over cash profits as it can be made favorable for the business as it can be legally manipulated. Cash profits indicate the profits in terms of real cash inflows and outflows.

If it costs $1 to produce a widget, the company’s COGS would be $2,000, and its gross revenue would be $8,000, or ($10,000 – $2,000). Calculate the accounting profit generated by Starbucks during FY22. Total Revenue is the total income generated by a company from the sales of goods & services. Cash FlowsCash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period.

purchase journal profit is a metric that is utilized to help access the status and overall financial health of an organization. Accounting profit is often displayed on company financial statements and is the net income earned by a company after subtracting all costs from revenue. Accounting profits surpassing implicit costs result in a positive economic profit for the firm, which should continue to operate. Accounting profits that are smaller than implicit costs result in a negative economic profit, and enterprises should divest in such cases. Items included in operating expenses are rent, salaries/wages for employees outside of production, business travel costs, property taxes, and research & development costs. So, although a business does not pay cash in exchange for its expenses or receive cash for revenues, it will still include them when calculating its accounting profit.

Accounting profit Vs other profits

Part of how economic profit works is the introduction of what is known as implicit costs. While this concept also exists in accounting, the economic model for profit factors in alternative uses of these implicit costs. As an example, let’s say you work for a company that creates construction materials such as concrete. In order to make concrete, your company owns a section of desert where sand is harvested that you then sell to contractors to make the concrete. In this example, your implicit cost is the sand, which you sell raw to another company that makes concrete rather than using it to make concrete yourself. The profit figure upon which the formula is based includes such non-cash expenses as depreciation and amortization, and so tends to understate the cash flows generated by a business.

Accounting profit, or the net income for a company, is often referred to as the bottom line. This definition of profit is used by accountants in order to help them identify how much money a company has earned after costs are subtracted from the company’s total income. Accounting profit is important because it represents the actual profits of a company, rather than the more theoretical values determined by economic profit. Profit is calculated by subtracting all expense incurred during a period from the total revenues earned in the same accounting period. Net profit is the profit that is left over after all the expenses which includes taxes and interest was paid.

The main difference between accounting profit and economic profit is that accounting profit specifically takes into account explicit costs only, which need direct payment. Conversely, economic profit will factor in implicit costs referring to company expense in opportunity costs incurred during resource allocations in diverse areas. Implicit costs aren’t considered by accountants in accounting profit calculations considering they’re yet to be incurred and hence just theoretical in the large scheme of accounting.